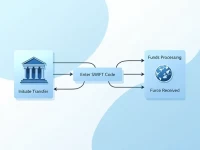

Guide to SWIFT Codes for International Transfers with Arab Banks

This article analyzes the standard SWIFT/BIC code ARABPS22XXX for Arab Bank and its application scenarios, emphasizing the importance of confirming bank information in international remittance to ensure smooth transactions.