Banco Central Del Paraguay SWIFT Code Guide for Secure Transfers

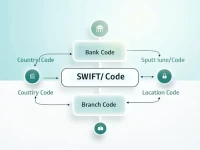

The article discusses the SWIFT code BCPAPYPRXXX of the Central Bank of Paraguay and its significance in international transfers. It provides scenarios for using this code, outlines the transfer process, addresses common issues, and highlights important considerations. The aim is to assist users in making safe and effective international remittances.