Banco Fortaleza Enhances SWIFT Security for La Paz Transfers

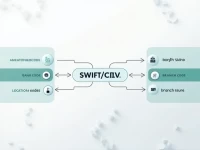

This article provides a detailed analysis of BANCO FORTALEZA SA's SWIFT code BFORBOLPXXX, explaining how to securely remit funds to La Paz and its key components. It offers essential points for readers to consider during the transfer process, ensuring that the funds reach the target bank accurately and safely.