Guide to SWIFTBIC Codes for Greek Banks

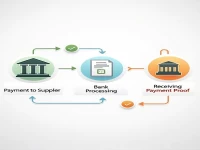

This article offers a comprehensive guide to Greek bank SWIFT/BIC codes, helping you easily find the correct code and avoid delays or errors in international money transfers. It covers the definition of the code, methods for finding it, frequently asked questions, and examples of popular bank codes. The goal is to ensure your international wire transfers are secure and reliable. Learn how to locate the right SWIFT code for any Greek bank and streamline your cross-border transactions with confidence.