Central Bank SWIFT Codes Streamline Crossborder Payments

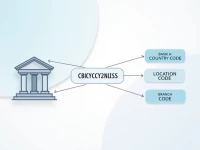

This article provides an in-depth analysis of the composition and role of the SWIFT code used by central banks, emphasizing the importance of accurately using SWIFT codes in international transactions to enhance the efficiency and security of cross-border financial dealings.