SHEIN Targets 24B Revenue with High Sellthrough Rates

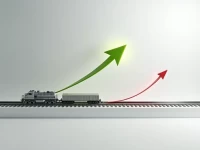

SHEIN has become a prominent player in fast fashion with an impressive 98% sell-out rate and an estimated $24 billion in annual revenue. Its success is attributed to an efficient supply chain, precise marketing, and rapid response to market trends. Despite facing environmental concerns and competitive pressure, SHEIN is actively exploring sustainable development and original designs, striving to maintain its leading position in the global market. It sets a new benchmark for Chinese brands going global.