Palestine Islamic Bank Enhances Secure International Transfers

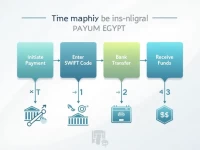

Understanding the SWIFT/BIC code PIBCPS22XXX of the Palestine Islamic Bank is crucial for making international remittances. This article delves into the uses and verification methods of the code, while also providing key factors to consider during remittance, such as transaction fees, transfer times, and risk management, helping users complete international transfers safely and efficiently.