Global Pet Toy Market Set for Expansion Key Trends Highlighted

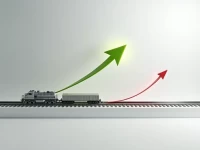

The global pet toy market is booming and projected to reach a significant size by 2032. North America currently leads the market, while the Asia-Pacific region is experiencing rapid growth. Rubber toys are popular, and there is increasing demand for innovative interactive toys. To capitalize on opportunities and secure future success, companies need to deeply understand the market, focus on product innovation, build a strong brand image, and expand their sales channels.