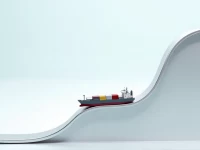

Prologis Reports Logistics Real Estate Demand Uptick As Trade Fears Ease

The Prologis IBI Index indicates a turning point in logistics real estate demand in Q3, with increases in net absorption, new lease signings, and project pipeline. This demand recovery is driven by business growth, structural investments in supply chains, and improved market conditions. Vacancy rates are expected to remain stable in the short term, with fewer projects under construction, potentially leading to a market tightening and accelerated rental growth.