Supply Chain Experts Address Transportation Recovery at CSCMP EDGE

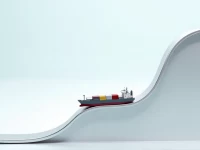

The CSCMP EDGE conference focused on the "State of the Transportation Industry." Experts discussed the freight recession, LTL market dynamics, and the impact of port strikes. Walmart suggested a return to seasonality as a turning point, while Grainger emphasized strong industrial demand. Dohrn Transfer highlighted self-discipline within the LTL market. Experts predicted that interest rate cuts could boost demand and drive industry recovery. The discussions provided insights into navigating current challenges and potential future growth in the transportation and supply chain sectors.