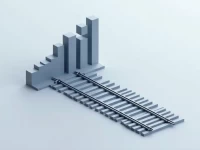

US Rail Freight Decline Points to Economic Slowdown

Recent data from the Association of American Railroads reveals a decline in both U.S. rail freight and intermodal volumes, signaling weakening economic demand. Mixed performance across specific commodity categories highlights shifts in the economic structure. Businesses should closely monitor market dynamics, optimize supply chain management, diversify operations, and embrace digital transformation to navigate these challenges. The decrease in freight volume serves as an indicator of a potential economic slowdown, requiring proactive adaptation from logistics and related industries.