Pound Slips Against Dollar Amid Economic Uncertainty

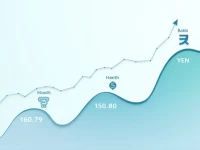

On August 8, 2025, the exchange rate of the Pound against the Dollar stood at 1.34441, indicating a 2.14% increase and surpassing the psychological threshold of 1.30. The Pound also experienced slight fluctuations against the Euro, Yen, and other major currencies, drawing significant market attention.