San Marinos Banca Di San Marino SPA SWIFT Code Guide for Global Transfers

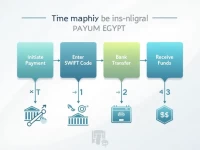

This article provides a detailed interpretation of the SWIFT/BIC code for BANCA DI SAN MARINO SPA, highlighting its significance in international remittances and how to effectively prevent remittance issues. It also introduces the advantages of using Xe for money transfers, including favorable exchange rates, transparent fees, and 24/7 customer support.