Rabobank Netherlands SWIFT Code Guide

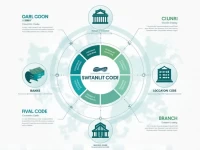

This article explains how to find the SWIFT code for Rabobank branches in the Netherlands, providing step-by-step guidance and strategies for encountering issues. It also discusses alternative solutions in case the branch SWIFT code cannot be located, ensuring the safety and efficiency of international remittances.