HSBC UK Explains SWIFT Codes for International Transfers

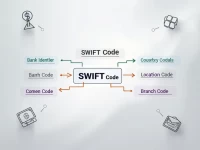

The SWIFT code for HSBC UK BANK PLC is HBUKGB4B72C. Using this code for cross-border remittances ensures that funds arrive securely at the designated bank. The article provides a detailed explanation of the structure of SWIFT codes and their significance in international financial transactions, offering readers practical guidance on cross-border remittance.