Understanding The Customs Clearance Process

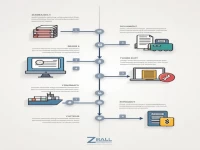

Customs clearance is a crucial step in international trade. The process involves preparing customs documentation, drafting the declaration, data entry, customs review, declaration, tax payment, and release of goods. Businesses must ensure the accuracy of each step to facilitate smooth customs clearance, maintaining the efficiency and security of goods transactions.