US Dockworkers Maritime Alliance Agree on Sixyear Labor Deal

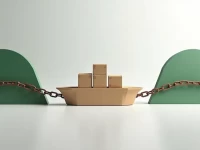

The International Longshoremen's Association (ILA) and the United States Maritime Alliance (USMX) have reached a tentative six-year agreement, aiming to ensure labor stability at East Coast and Gulf Coast ports. A key focus is balancing automation advancement with workers' rights, averting potential strike disruptions. The agreement's ratification and implementation will significantly impact the supply chain. Continued collaboration between the ILA and USMX is crucial for achieving mutual benefits and fostering a stable and efficient port environment. This agreement is a significant step towards ensuring supply chain resilience.