Somali Shilling Weakens Against US Dollar Amid Economic Pressures

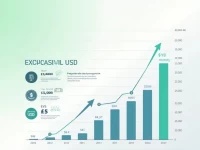

According to the latest exchange rates, 25 Somali shillings can be exchanged for approximately 0.04 USD. This report provides an in-depth analysis of the fluctuations in the SOS to USD exchange rate and advises readers to be aware of potential fee differences that may occur during actual exchanges.