Understanding The Differences Between Tax-free Shopping And Direct Import Shopping

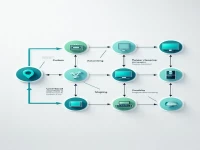

This article focuses on the two main models of cross-border e-commerce: bonded shopping and direct purchase imports. The bonded shopping model utilizes bonded warehouses for rapid shipping, while direct purchase imports involve sending goods directly from abroad. Understanding the differences, advantages, and disadvantages of these two methods is crucial for consumers to make informed shopping choices in a rapidly changing market environment.