Prologis Reports Shift in Logistics Real Estate Demand

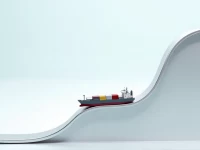

The Prologis IBI index indicates a turning point in logistics real estate demand, with increases in net absorption, new leases, and project pipeline. The report reveals that companies are actively responding to trade uncertainties and increasing supply chain investments. Improved utilization and market conditions are key drivers of demand growth. Vacancy rates are expected to remain stable in the short term. However, in the long term, a tightening construction pipeline could lead to market tightening again, potentially accelerating rental growth.