Secure Fund Transfer Tips for Crdit Agricole Italia Clients

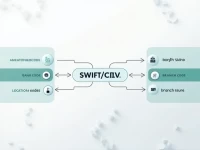

The SWIFT code CRPPIT2P004 of CREDIT AGRICOLE ITALIA S.P.A. is crucial for ensuring the safety and accuracy of international transfers. Understanding the structure and usage of SWIFT codes can help you conduct cross-border transactions efficiently, avoiding delays or errors and ensuring that each payment reaches its destination accurately.