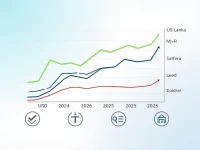

Sri Lankan Rupee Weakens Against US Dollar Amid Economic Pressures

This article analyzes the current exchange rate and fluctuations of the Sri Lankan Rupee (LKR) against the US Dollar (USD), with the latest data showing that 1 LKR equals 0.00332541 USD. It explores the market trends and investment strategies behind the exchange rate fluctuations, providing important references for investors.