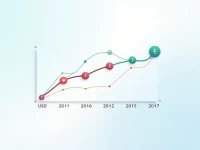

SDGCAD Exchange Rate Trends Impact Wealth Growth Strategies

This article explores the exchange rate dynamics between the Sudanese pound (SDG) and the Canadian dollar (CAD), emphasizing the importance of understanding exchange rate fluctuations for investment. It provides practical advice on how to respond to and leverage these changes in the exchange rate.