Denizbank AS Enhances Security for International Transfers

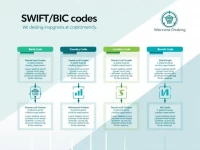

This article introduces the SWIFT/BIC code DENITRIS340 for DENIZBANK A.S., providing essential information and considerations for international transfers. Ensuring the correct use of the SWIFT code, as well as understanding the fees and exchange rate fluctuations during the remittance process, contributes to the secure and efficient arrival of funds.