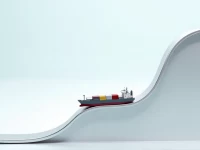

Airlines Stabilize Profits Amid Supply Chain Geopolitical Risks

The International Air Transport Association (IATA) forecasts a stable net profit margin of 3.9% for the global airline industry in 2026, with total profits reaching $41 billion. Despite facing supply chain challenges, geopolitical risks, and regulatory pressures, air cargo demonstrates resilience. The report highlights the need to address the imbalance between profitability and value creation, and focuses on the differentiated performance of various regional markets. This includes navigating fuel price volatility and adapting to evolving consumer demands to maintain sustainable growth.