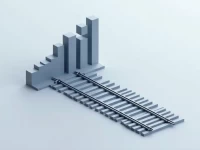

US Rail Freight Volumes Decline Amid Demand Concerns

Data from the Association of American Railroads shows a year-over-year decline in US rail freight and intermodal volumes. This article delves into the underlying causes, including economic slowdown, supply chain bottlenecks, and energy transition. It explores the impact on the logistics industry, encompassing railroad companies, trucking firms, ports, and freight forwarders. Finally, the article examines the challenges and opportunities facing rail freight, and discusses how the industry should respond to navigate the evolving landscape.