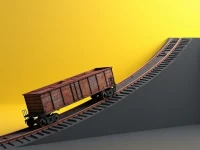

US Rail Freight Trends Diverge Amid Economic Uncertainty

US rail freight shows a divergence: carload traffic increased by 2.8%, while intermodal traffic decreased by 5.8%. Year-to-date figures reveal a similar trend, with carload volume increasing and intermodal volume declining. This divergence could reflect shifts in supply chains, consumer demand, or fuel costs. Further analysis is needed to understand the underlying drivers and potential long-term implications for the rail freight industry and the broader economy.