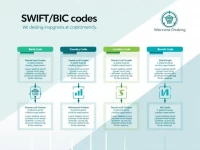

Guide to SWIFT Codes for Moldovas Victoriabank

This article explains how to effectively find the SWIFT code for the United Commercial Victoria Bank and its remittance services. When making remittances, choosing the Xe platform can provide better exchange rates, lower fees, and faster processing times. Readers are also reminded to verify information before transferring funds to ensure security.