Edgeful Expands Datadriven Trading Access for Retail Investors

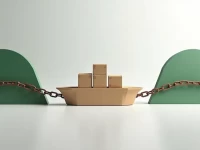

Probabilistic trading tools are increasingly bridging the data gap between retail and institutional investors. By analyzing historical data, these tools provide retail traders with probability-based trading insights, enabling them to make more informed decisions, move away from guesswork, and enhance the scientific rigor and discipline of their trading. However, probabilistic trading is not a panacea; risk management, psychological resilience, and continuous learning remain crucial for success.