JSC Credo Bank SWIFT Code Eases Georgian Remittance Transfers

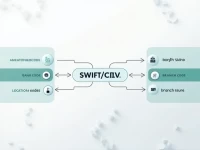

This article provides a detailed explanation of JSC Credo Bank (Georgia)'s SWIFT/BIC code, JSCRGE22XXX. It clarifies its structure, usage scenarios, and important considerations. Furthermore, it offers practical advice to avoid errors during international money transfers. The aim is to help users conduct international remittances safely and efficiently when using Credo Bank. The information provided ensures users understand the code and can confidently use it for international transactions.