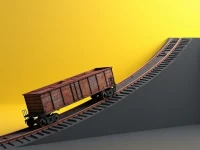

US Rail Freight Rebounds Despite Industry Challenges

US rail freight growth slowed in late July, with increases in commodities like coal offset by declines in automobiles. Intermodal transportation remained robust but faced congestion. The market presents both opportunities and challenges, requiring collaboration and innovation to navigate. Overall freight volume saw modest gains, reflecting the current state of the US economy and the ongoing shifts in consumer demand and supply chain dynamics. Further monitoring of these trends is crucial for understanding future economic performance.