Sparebank 1 Srnorge ASA SWIFT Code Explained

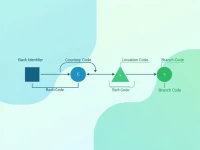

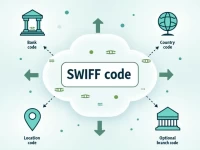

This article provides a detailed overview of the SWIFT code SPIRONO22FOR for SPAREBANK 1 SOR-NORGE ASA, helping readers understand the bank's international remittance process and the components of the SWIFT code. It explains the key functions of the SWIFT code and its significance in reducing the risks associated with money transfers.