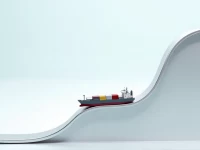

LTL Carriers Adapt to Boost Logistics Efficiency

Facing booming e-commerce and last-mile delivery pressures, companies need to reshape their relationships with LTL carriers. Optimizing carrier networks, establishing clear contracts, and becoming a 'carrier-friendly' shipper can effectively address market challenges, improve logistics efficiency, and build a more resilient supply chain. This approach enables businesses to navigate market competition effectively and ultimately stand out from the crowd.