Chinas Import Rules for Frozen Goose HS 0207332000 Explained

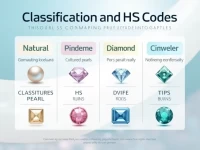

The article provides detailed information about HS Code 0207332000 for frozen whole geese, including tax rates, classification, and regulatory conditions for import and export. This information aims to help businesses engaged in import and export better understand the trade environment for this product.