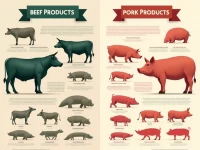

Global Trade HS Codes Explained for Beef and Pork

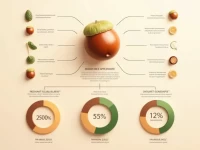

This article systematically analyzes the HS codes related to beef and pork, providing classifications of different products, export tax rebate rates, and regulatory conditions. It serves as a reference for exporters to understand market dynamics and compliance.