Guide to Sebs SWIFTBIC Codes for International Banking

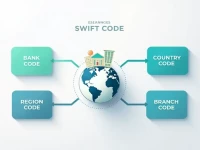

Understanding the SWIFT/BIC code ESSESESSCAL of SKANDINAVISKA ENSKILDA BANKEN AB is crucial for ensuring the safety and speed of cross-border remittances. This article will delve into the composition and practical applications of SWIFT codes, highlighting how using the correct bank code can optimize the international remittance process and enhance the security of funds.