HSBC Australia SWIFT Code Eases International Transfers

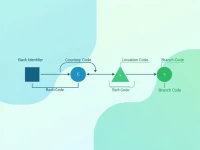

This article introduces the SWIFT code HKBAAU2SPTH for HSBC Bank's Australian branch and its usage. It emphasizes the importance of using the correct SWIFT code in international remittances. This will assist users in ensuring that funds reach the designated account quickly and securely while reducing the risks associated with cross-border transactions.