Analysis Of Air Freight Prices From Zhengzhou To Antalya

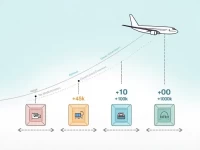

This article provides air freight rates and detailed flight information from Zhengzhou to Antalya. According to Turkish Airlines, the freight charges are categorized by cargo weight and include specific flight departure and arrival times along with aircraft types. Additionally, readers are reminded to pay attention to extra fees and fluctuations in freight rates.