Pound Strengthens Against Dollar Amid Market Volatility

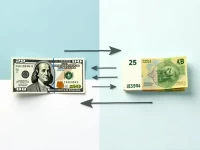

This article discusses the current dynamics of the exchange rate between the US Dollar (USD) and the British Pound (GBP), clarifying the impact of exchange rate fluctuations on currency conversion. It emphasizes the exchange fees that need to be considered in actual transactions. Understanding this information is crucial for international travel, studying abroad, or engaging in trade.