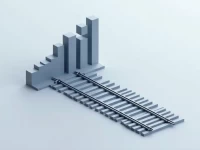

US Rail Freight Slumps in May Amid Economic Uncertainty

Data from the Association of American Railroads shows a year-over-year decline in U.S. rail freight and intermodal volumes in May, reflecting a mixed economic picture. Performance varied across sectors, with some industries recovering while grain and metals shipments decreased. Year-to-date freight volumes showed slight growth, but intermodal remained weak. Factors like global economic slowdown, supply chain disruptions, and volatile energy prices impact the freight market. Future challenges require increased investment and improved efficiency.