Global Container Shipping Demand Dips Ports Face Challenges

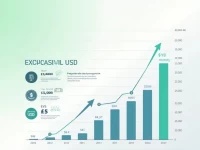

US container shipping volumes continued to decline in the first quarter of 2023, influenced by shifts in consumer spending and West Coast port labor negotiations. This decrease signals a potential economic slowdown, impacting employment and the supply chain. The industry should embrace digitalization, strengthen intermodal cooperation, expand diversified services, and focus on emerging markets to seize opportunities for transformation and upgrading. The downturn highlights the need for resilience and adaptability within the container shipping sector to navigate economic uncertainties and evolving global trade dynamics.