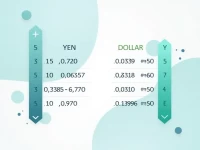

Yen Weakens to 100 Yen Per 067 Amid Dollar Strength

Latest data shows that 100 Japanese yen can be exchanged for approximately 0.67 US dollars, with the current value of 1 yen being 0.00677065 US dollars. The specific exchange rate dynamics provide important reference points for decisions made by individuals and businesses.