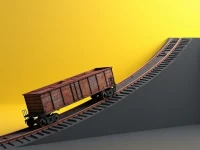

US Rail Freight Decline Signals Economic Slowdown

According to the Association of American Railroads, U.S. rail freight and intermodal volume decreased year-over-year for the week ending August 5th. While cumulative freight volume year-to-date saw a slight increase, intermodal volume experienced a significant decline. Performance varied across different commodity categories, reflecting the complexity of the economic structure. This data should be analyzed in conjunction with other economic indicators for a comprehensive understanding.