South African Rand Fluctuates Against US Dollar Amid Market Shifts

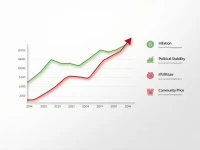

The article analyzes the dynamic changes of the South African Rand against the US dollar and the influencing factors. It explores market trends and offers real-time monitoring tools and services to help investors grasp exchange rate fluctuations and make business decisions.