Nordea Bank Explains SWIFTBIC Codes for Global Transfers

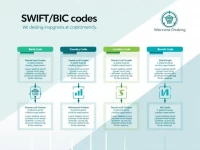

This article analyzes the composition and significance of the SWIFT/BIC code for NORDEA BANK ABP, FILIAL I SVERIGE. It emphasizes the key elements that need to be confirmed before remittance and the advantages of choosing Xe for international transfers, helping readers avoid issues and delays in the remittance process.