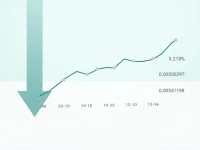

USD Weakens Against JPY As Exchange Rate Hits 1477

The current exchange rate of the US dollar to the Japanese yen is approximately 1476.98 yen for 10 dollars, reflecting market fluctuations and economic interactions. Investors and consumers need to pay attention to exchange rate volatility and its related impacts to make informed financial arrangements and investment decisions.