Nigeria Tops African Stock Markets Amid Divergent July Growth

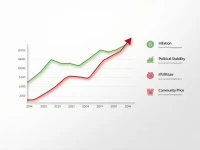

African stock markets showed mixed performance in July. The Nigerian stock market led the gains with a 16.56% increase, while the South African stock market rose by 2.28%, although Rand depreciation may pose challenges. Mauritius and Kenya also recorded growth. Investors should pay attention to the economic differences between countries and make cautious decisions.