EU and Taiwan Advocate Ending Preshipment Inspections to Ease Trade

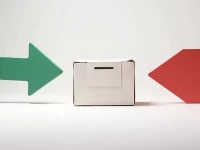

The EU and the Separate Customs Territory of Taiwan, Penghu, Kinmen and Matsu submitted a proposal to the WTO advocating for the phased elimination of pre-shipment inspection (PSI) by all members to facilitate trade. The proposal outlines differentiated timelines for members based on their development levels, emphasizing transitional arrangements and technical assistance. Eliminating PSI is expected to reduce trade costs and improve efficiency. However, it also highlights the importance of customs capacity building and risk management to ensure smooth trade flows and prevent potential abuses after PSI removal.