Freight Market Diverges from Broader Economy Analysts Say

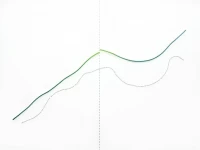

Armada analyst Prather highlighted a 'decoupling' between the freight market and macroeconomics at the SMC3 J conference. Analyzing historical data, he found they don't always move in sync. Changes in inventory management, supply chain structures, and consumer habits contribute to this divergence. Logistics companies need to analyze the market deeply and develop appropriate strategies to navigate this disconnect.