Introduction

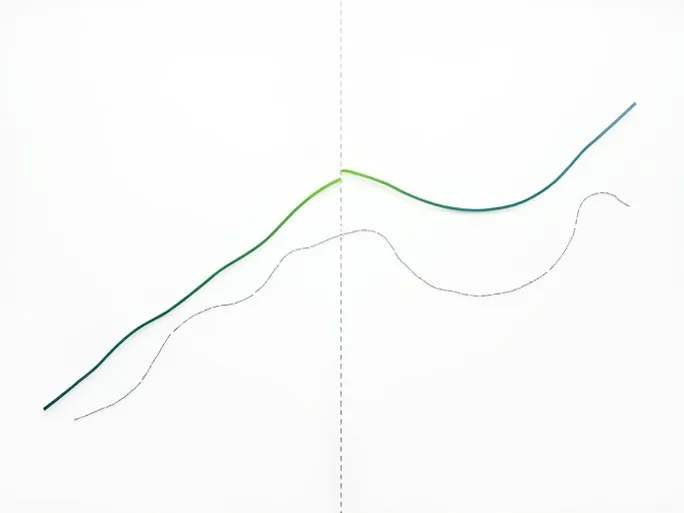

In today's globalized economy, freight markets serve as vital connectors between production, distribution, and consumption, traditionally reflecting macroeconomic health. However, a puzzling phenomenon has emerged in recent years: despite strong macroeconomic indicators and robust consumer demand, freight markets have failed to show corresponding growth. This disconnect has raised concerns among logistics companies, economists, and policymakers alike.

Freight Markets: The Economic Barometer

Freight markets facilitate the movement of goods through various transportation modes (road, rail, maritime, and air), serving as both economic enablers and indicators.

Functions and Roles

- Production-Consumption Linkage: Bridges manufacturing centers with consumer markets

- Trade Facilitation: Reduces distribution costs and expands market reach

- Resource Optimization: Balances regional supply-demand disparities

- Industrial Support: Provides critical logistics infrastructure for sectoral growth

- Employment Generation: Creates millions of transportation and logistics jobs

Market Segmentation

Freight markets can be categorized by:

- Transport mode (road/rail/maritime/air)

- Distance (short-haul/long-haul)

- Cargo type (general/specialized/hazardous)

- Customer base (B2B/B2C)

The Disconnect Phenomenon

Key manifestations include:

- Divergence between GDP growth and freight volume trends

- Increased consumer spending without proportional freight demand

- Manufacturing PMI recovery with lagging freight response

- Declining profitability among logistics providers

Global Case Studies

United States: GDP growth has outpaced freight volume increases due to shifting consumption patterns and inventory management evolution.

European Union: Geopolitical tensions and energy price volatility have suppressed freight activity despite economic recovery.

China: Economic deceleration and real estate sector challenges have impacted freight demand, offset by multimodal transport development.

Root Causes of Disconnect

Structural Economic Shifts

- Service sector growth outpacing goods consumption

- E-commerce reducing traditional retail freight needs

- Customization driving smaller, more frequent shipments

Operational Transformations

- Lean manufacturing reducing inventory requirements

- Just-in-Time logistics minimizing warehousing needs

- Enhanced supply chain coordination through digital platforms

Geopolitical and Policy Factors

- Supply chain regionalization and reshoring initiatives

- Trade policy shifts impacting international freight flows

- Monetary policy affecting business investment cycles

Global Supply Chain Realignment

The current supply chain restructuring presents both challenges and opportunities for freight markets:

Key Trends

- Regional procurement strategies reducing transport distances

- Diversified sourcing increasing route complexity

- Digital transformation enabling smarter logistics

- Sustainability requirements driving modal shifts

Strategic Responses for Logistics Providers

Operational Adaptations

- Advanced demand forecasting systems

- Dynamic inventory optimization techniques

- Integrated multimodal transport solutions

Technological Integration

- IoT-enabled asset tracking

- AI-driven route optimization

- Blockchain-based documentation

Market Expansion

- Emerging economy penetration strategies

- Specialized service offerings

- Green logistics initiatives

Policy Considerations

Government actions could facilitate market realignment:

- Transport infrastructure modernization

- Regulatory streamlining for logistics operations

- Technology adoption incentives

- International trade facilitation measures

Conclusion

The freight-macroeconomy disconnect reflects fundamental structural changes in global commerce rather than temporary market anomalies. Successful navigation of this new landscape will require adaptive strategies from logistics providers and supportive policy frameworks. The industry's ability to leverage technological innovation while addressing sustainability concerns will determine its future trajectory in an evolving economic environment.